Global Equity Fund Limited (GEF) was established in 2019 as Nepal’s pioneering Private Equity Fund Manager. We proudly hold a ‘Fund Management License’ from the Securities Board of Nepal (SEBON) since August 9, 2022, under the Specialized Investment Fund Regulation 2019. As a sector-agnostic impact fund manager, we specialize in providing crucial funding to small and medium-sized enterprises (SMEs) across their early, expansion, and growth stages. Our investment philosophy is rooted in creating value through profound market insights, operational expertise, and strategic connections. We firmly believe that our capital, coupled with operational excellence and robust governance, can catalyze significant financial and social outcomes at a meaningful scale. We collaborate closely with founders, offering support to expand their ventures and magnify their societal impact.

We are distinguished as Nepal’s premier domestic institutional Private Equity and Venture Capital (PE/VC) Fund Manager. Global Equity Fund is backed by Himalayan Life Insurance, Himalayan Everest Insurance, Khetan Group (Rajendra K. Khetan), Bhuramal Lunkarandas Conglomerate- BLC (Basanta K. Chaudhary), and professionals from diverse sectors.

We are distinguished as Nepal’s premier domestic institutional Private Equity and Venture Capital (PE/VC) Fund Manager. Global Equity Fund is backed by Himalayan Life Insurance, Himalayan Everest Insurance, Khetan Group (Rajendra K. Khetan), Bhuramal Lunkarandas Conglomerate- BLC (Basanta K. Chaudhary), and professionals from diverse sectors.

Our Mission

Our mission is to drive Nepal’s economic advancement through:

Investing in enterprises committed to ethical practices, ensuring reliable and high-performing returns

Cultivating dynamic, innovative, and open-minded communities by fostering partnerships among businesses and stakeholders, encouraging the sharing and embracing of knowledge

Building sustainable and responsive brands that prioritize customer trust and satisfaction, creating customer-centric experiences at their core

Cultivating a culture that values diversity, inclusivity, and creativity, fostering both individual and collective talent, encouraging personal expression, and nurturing untapped potential

Our Mission

Our mission is to drive Nepal’s economic advancement through:

Investing in enterprises committed to ethical practices, ensuring reliable and high-performing returns

Cultivating dynamic, innovative, and open-minded communities by fostering partnerships among businesses and stakeholders, encouraging the sharing and embracing of knowledge

Building sustainable and responsive brands that prioritize customer trust and satisfaction, creating customer-centric experiences at their core

Cultivating a culture that values diversity, inclusivity, and creativity, fostering both individual and collective talent, encouraging personal expression, and nurturing untapped potential

Our Vision

At our essence, we aim to stand as the foremost investment fund management company, dedicated to maximizing value for our shareholders and actively contributing to the economic development and well-being of our nation.

In our pursuit of becoming a leading investment fund management entity in Nepal, we are resolute in maintaining ethical standards, ensuring:

– Superior returns for our Investors

– Exceptional services for our clients

– Career growth opportunities for our employees

– A profound sense of corporate responsibility to our society

Key Investment Sectors

Education

Tourism

IT

Clean Energy

Agriculture

Health Care

Investment Approach

OUR UNIQUE INVESTMENT APPROACH

“Empowering Growth Through Strategic Capital Deployment”

Our investments are focused in diversified sectors in established and growth-oriented businesses alike. We play a vital role in helping companies realize their growth potential. We uncover their value by identifying great companies and enhancing their performance by providing patient capital and operating support to strong management teams. Our approach helps our portfolio companies grow core businesses, launch new initiatives, make transformative acquisitions, and upgrade technologies and systems to support their long-term strategies.

Our investment approach goes beyond capital. We seek to make the companies we invest in stronger through a bottom-up strategy of transformation. Crucially, we bring the expertise of our ‘Portfolio Operations Group’ to provide strategic guidance on various operational improvements, including revenue growth, procurement leadership development, lean process and IT optimization, energy sustainability, and employee growth. Our reputation for trustworthiness, collaborative approach, and operational guidance makes us the ideal investment partner. We take pride in being a “Strategic Capital” provider, leveraging a unique blend of operating and financial professionals to play a transformative role in our portfolio companies. Since our inception, we have remained steadfast in our strategy, building trust-based relationships with our partners and management teams.

Our investment philosophy revolves around governance, promoter, business quality, and exit strategy. This entails prioritizing companies with strong governance, high-quality management, and a well-defined exit strategy. By maintaining this focus, we aim to deliver long-term value, offering consistent and superior risk-adjusted returns while minimizing risks.

Our investments are focused in diversified sectors in established and growth-oriented businesses alike. We play a vital role in helping companies realize their growth potential. We uncover their value by identifying great companies and enhancing their performance by providing patient capital and operating support to strong management teams. Our approach helps our portfolio companies grow core businesses, launch new initiatives, make transformative acquisitions, and upgrade technologies and systems to support their long-term strategies.

Our investment approach goes beyond capital. We seek to make the companies we invest in stronger through a bottom-up strategy of transformation. Crucially, we bring the expertise of our ‘Portfolio Operations Group’ to provide strategic guidance on various operational improvements, including revenue growth, procurement leadership development, lean process and IT optimization, energy sustainability, and employee growth. Our reputation for trustworthiness, collaborative approach, and operational guidance makes us the ideal investment partner. We take pride in being a “Strategic Capital” provider, leveraging a unique blend of operating and financial professionals to play a transformative role in our portfolio companies. Since our inception, we have remained steadfast in our strategy, building trust-based relationships with our partners and management teams.

Our investment philosophy revolves around governance, promoter, business quality, and exit strategy. This entails prioritizing companies with strong governance, high-quality management, and a well-defined exit strategy. By maintaining this focus, we aim to deliver long-term value, offering consistent and superior risk-adjusted returns while minimizing risks.

Our Investment Principles

“Empowering Growth, Inspiring Impact”

At the heart of our investment philosophy is a commitment to principled and strategic capital deployment. We believe that sound principles guide successful investments, fostering trust, sustainability, and long-term value creation. Our approach is rooted in a dedication to transparency, a ‘Founders First’ mindset, a willingness to embrace innovation and risk. These principles serve as the cornerstone of our strategy, shaping our decisions and actions.

– Entrepreneurs at the center: Adopting a ‘Founders First’ approach, we partner with entrepreneurs with respect, agency, and trust.

– Lean into Risk: Embracing innovation in frontier markets, we push boundaries to prove innovations and help portfolio companies realize their full potential.

– Go Beyond Capital: We design our support offering to address critical growth barriers, utilizing our expertise and networks for outcomes that are transformational, sustainable, and replicable.

– Impact as the Competitive Advantage: For us, impact investment aligns social or environmental purpose with financial gains, creating opportunities for innovative companies.

– Transparency into Action: Committed to transparency, we share successes, failure, and actionable insights with the wider ecosystem.

– Entrepreneurs at the center: Adopting a ‘Founders First’ approach, we partner with entrepreneurs with respect, agency, and trust.

– Lean into Risk: Embracing innovation in frontier markets, we push boundaries to prove innovations and help portfolio companies realize their full potential.

– Go Beyond Capital: We design our support offering to address critical growth barriers, utilizing our expertise and networks for outcomes that are transformational, sustainable, and replicable.

– Impact as the Competitive Advantage: For us, impact investment aligns social or environmental purpose with financial gains, creating opportunities for innovative companies.

– Transparency into Action: Committed to transparency, we share successes, failure, and actionable insights with the wider ecosystem.

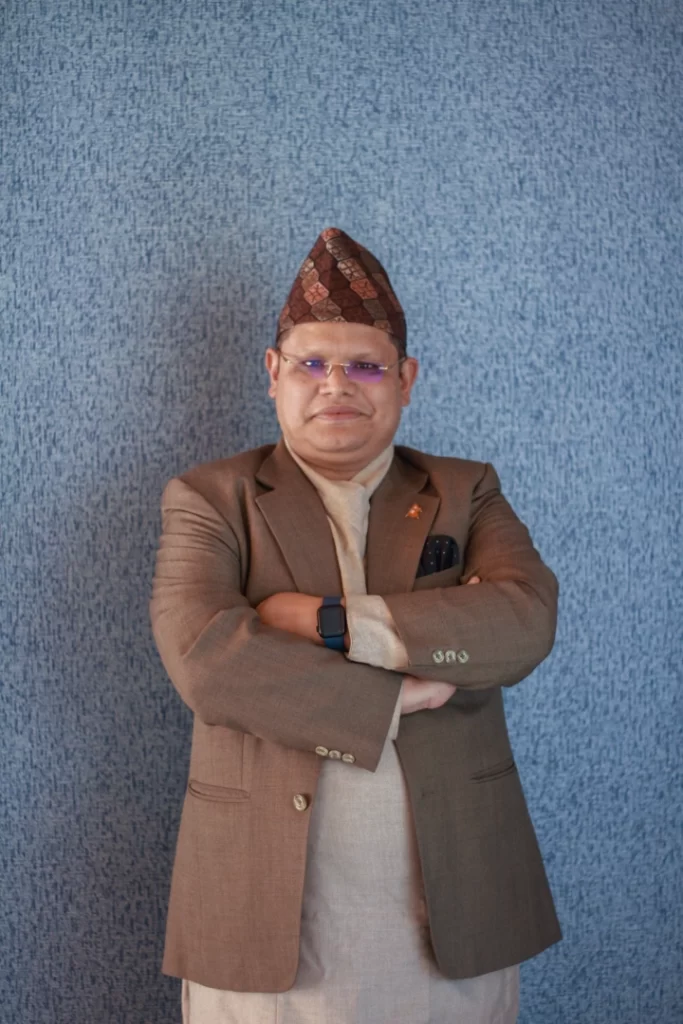

Our Team

Board of Directors